by Dr David Phelps

There are specific ways to structure and do real estate investing that creates the ability to participate in different ways.

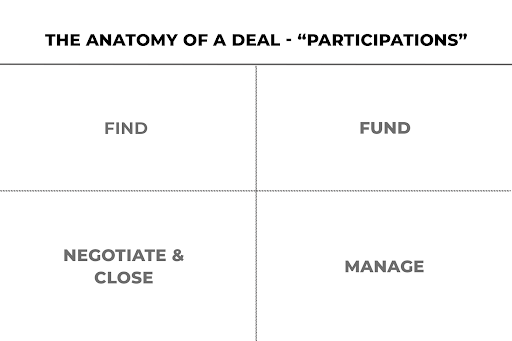

This framework is what I call “participations” or as some call it, the anatomy of a deal structure.

This April, I will be hosting a private, small group of docs who want to learn about the fundamentals of real estate investing. The goal is to give you a crash course in how to invest in real estate the RIGHT way, based on the lessons I’ve learned the hard way over 40+ years of investing through good times and bad. (This week is your last chance to join. It's a small group – space is limited. Learn more and save your seat here.)

Today’s blog is a short preview of a training that I usually only give to participants of my online course. With the banking system and our economy in upheaval, however, I felt it best to share these frameworks of how one should begin to invest in real estate. I hope this helps you begin your journey while giving you a taste of what we will be learning this April in my real estate online course.

There are Different Ways to do Real Estate Investing

There are specific ways to structure real estate investments to create the ability to participate in different ways. This framework is what I call “participations” or as some call it, the anatomy of a deal structure.

Oftentimes when we're first starting out, the way I did, we control the entire investment. In my case, I bought single family houses, I managed the contractors that renovated the house, I managed the tenants, I did everything. That's one way to do it.

But as we evolve, we may have other interests and other businesses where our time is more valuable. We still want to be on the forefront of making good investments and this is where there can be different ways to participate.

If you understand the concepts of how you can participate in real estate deals, you can potentially position yourself to take advantage of the real estate markets. And, if you go through my four week online course, you’ll also understand where the deals are and how you can more wisely participate according to your situation.

The Anatomy of a Real Estate Deal – The Framework I Use

This framework is structured into four quadrants as shown below.

The four key aspects of putting a deal together that I will break down today are finding a deal, negotiating and closing a deal, funding a deal, and managing that property/investment.

#1 – Finding a Real Estate Deal

Someone has to find good opportunities in real estate. Typically these are people who are, what I call, “boots on the ground”. They have a specific niche business in real estate where they get involved in finding single family houses or self storage or multi-family apartments or any different classification of real estate.

They typically create a network by marketing and generating leads to find sellers who will sell them properties at prices or terms to make a good deal. Usually this line of work is a good fit for younger people who have more time than money and can learn how to network and generate leads. I did a lot of this when I was younger. Today, not so much.

Finding a property has value all by itself. If somebody is good at finding properties, they are bringing value to the table. They can find deals for other people who know how to operate them, and there are simple ways to get paid for that value. You can get paid a commission of some sort, like real estate agents would, or you can take a participation in the deal or a combination thereof.

But finding the deal doesn’t mean the deal is done.

#2 – Negotiating and Closing

Someone has to negotiate and close the deal. That could be the same person who finds the deal. They could have the same skill set that would allow them to find and negotiate and close a contract that has the price and terms that makes sense from an investment standpoint. These people also need to know how to take it to closing at a title company.

Again, this aspect provides value on its own and could be a different person than the one who found the property. Negotiating a closing of a deal is a very high value. So, one can get paid for that at a very high level, or you could take a participation in a deal.

#3 – Funding a Real Estate Deal

This is where the capital or financing comes in and where you have an opportunity to get creative.

Every deal takes some form of financing whether you go to a bank and use some of your money to pay the down payment, OR you use private capital – this is what many syndications will do along with their institutional financing.

You can also get sellers to carry back on some terms, opportunities that will become much more available as we go through recessionary corrections in the marketplace. This happens because banks will tighten up and liquidity will become much less available, creating all kinds of opportunities in terms of financing.

Funding a real estate deal has merit on its own as well. It’s what most high income earners think of when they think of investing in real estate. Today, funding is a lot of what I do.

If you're in this third category of being able to fund real estate deals, you have the opportunity to participate passively. You can take some of your capital and move it into alternatives (real estate). Whether it's taxable money or your self-directed IRA (retirement account money) you can participate as a funder.

There’s different ways, again, to take those participations when funding a deal. You can focus more on cash flow, growth or a combination thereof. We will get into this more in my online course, but there are so many ways to slice and dice the opportunities in real estate while keeping your capital safe at the same time.

Now once the property or properties are acquired, you typically add value to them (usually with remodeling or rehabbing) to increase the cash flow. Then you or they (depending on how you participate) hold them in a portfolio for a longer term. You could, after a few years of increasing rents and the valuation, sell the property and take a profit as a long-term capital gain. But this brings up the last part of a real estate deal.

Who takes care of the property during rehab? Who takes care of the property long term before it’s sold?

#4 – Managing the Real Estate Property

Many times people forget that someone will still have to manage the property in a real estate deal. Who's going to manage the tenant and the operations? My response today is, find people who are good at that.

You can make a lot of money being a manager of properties, really, managing anything. You can make good money, but it’s a full-scale operation, a full time job. You can do this yourself like I did when I was younger with my own properties. That was good then because I was putting my time in and scaling that way.

Today, however, I no longer manage the properties I invest in. My time is more valuable elsewhere. I'd rather pay other people to take some of the profit of the deal and let them manage the whole thing.

But curating those people who can do each of these aspects of a real estate deal, the right people, is another art form and skillset that we'll dig into during my four week online course.

If you miss this key aspect of finding the right people, then all your other great intentions can go awry and you may make some very bad mistakes in your real estate investing. So, creating your team is something we will cover in detail then.

However, if you’re doing it alone, this framework is what I found to be helpful when participating in all or any one of these aspects.

Be sure to keep this framework in mind when putting together or participating in any real estate deal.

To your freedom!

– David

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with My Team:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then schedule a call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to attend one of our upcoming member events as a guest. www.freedomfounders.com/schedule

2. Become a Full-Cycle Investor:

There are many self-proclaimed genius investors today who think everything they touch turns to gold. But they’re about to learn the hard way what others have gained through “expensive” experience. I’m offering a free report on how to become a full-cycle investor, who knows how to preserve and grow capital in Up and Down markets. Will you be prepared when the inevitable recession hits? Get your free report here.

3. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Click here to take the 3 minute assessment and get your scorecard.