W

e've been here before. What am I talking about? Unless you've been sleeping under a log, you probably heard that

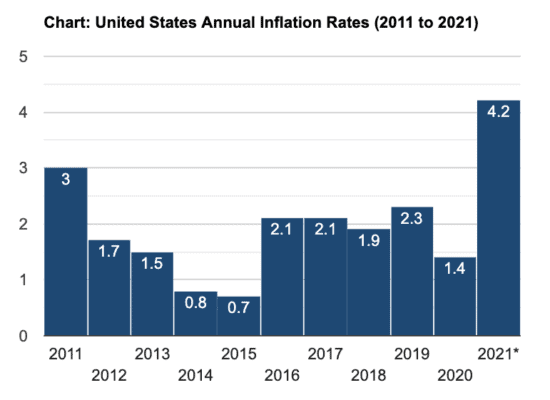

in April of this year inflation skyrocketed to a 4.2% annualized rate.

Where's this coming from?

Well, looking at this last year of the coronavirus pandemic, we've had stimulus bill after stimulus bill, which started with President Trump and continued with the Biden administration. They are rolling out more and more money to businesses and consumers. Now I'm not saying that they shouldn't have done that – I'm just saying this is what we’re looking at.

In comparison, in 2008 the Great Recession was met by the Obama administration pumping out $800 billion of stimulus money into the economy.

$800 billion. We're at $5 TRILLION of stimulus now since the start of the pandemic. On top of that, President Biden is proposing a $6 trillion infrastructure spending bill.

Regardless of who’s in control, Republican or Democrat, this country is on a spending spree – but how will they pay for it all?

You and I both know that it will come from the taxpayers eventually… but will that be enough? Taxation is unpopular, and taxing even the wealthiest people doesn’t put a dent in it. The only politically feasible way for our government to pay for this debt is to monetize the debt through inflation.

So here we are. We haven't seen this level of potential inflation since back in the ‘60s and ‘70s. Now, some of you weren't around then or may have been too young to notice the economic impact of inflation.

I grew up in that era. I was a teenager in the ‘60s, and in the ‘70s I was leaving high school to go to college then onto dental school. I was young, so I didn't know what was going on, but now I’ve studied the history and economics of the era.

In the ‘60s with President Johnson we had what was called the Guns and Butter era. While funding the Vietnam War, Johnson’s administration also maintained their domestic spending on the Great Society programs.

Like today’s stimulus spending, the increased government spending of the ‘60s laid the foundation for a jump in inflation. Inflation in the late ‘60s grew to 5.5%, then up to 10% through the ‘70s.

Due to other crises in the ‘70s like the Arab-Israeli War and the OPEC Oil Embargo, the economy was very much in malaise. The economy grew slowly, if at all, while inflation ran wild. Those economic conditions are called stagflation, and in some ways they correlate with our economic situation today.

Thankfully, our studious politicians have always been there to “save the day”… on a short term basis. Politicians never play the long game because they're not going to be around that long. They do what they need to do to keep themselves in office. It’s all self-preservation.

You can't fight this thing, folks. You can say it's not fair all day long, but the only way to deal with it is to learn how to capitalize on the moment.

Historically, we know what’s coming and how to navigate these trends. The most important thing to remember moving forward is that you cannot play the game with the same financial model you’ve been using.

Your financial advisor likely hasn't worked through a period of major inflation like what occurred in the ‘70s – a decade in which stock market investors lost 49% after adjusting for inflation. Unfortunately, that means your advisor isn’t going to know how to navigate what’s coming. Interest rates can only go up from here, which kills the traditional model of stocks, bonds, and annuities.

In order to capitalize on what’s coming, you have to think not only about being defensive and hedging your bets, but also how to go on the offensive and position yourself for the opportunities.

Every time we have a major upheaval after a bull market run, there is a massive wealth transfer. In this case, the correction is going to come in terms of inflation, and very likely a big reset in the financial markets.

Don't be one that sits back on your hands and just hopes for the best, or leaves it to your financial advisor. They'll do the best they can, but they don't really know how to succeed in this new era. They don't have the access to the real investment opportunities that can help you not only make it through, but actually thrive and take advantage of the wealth transfer that's coming.

That's where you need to be. If you miss this opportunity, it could set you and your family back literally for decades.

I believe we are in a major generational shift right now in so many different areas: Societal, political, economic. I see this as a tipping point, an economic crossing of the Rubicon into a new era. Again, I don't like it. I don't like the things that are happening in this country one bit, but I can't change the overall big trends.

All I can do is work hard to preserve my own and my family’s sovereignty, and then help other people do the same thing.

Don't get left behind with your same financial roadmap. Stay informed from people who have been there. We'll show you the way through.

I’ll be releasing more content moving forward to help you navigate this, starting next Tuesday at 12pm. You’re invited to join me for a free webclass where I’ll dig into inflation, what it means for you, and how you can put yourself in the strongest financial position – click here to reserve your seat.

To your freedom!-David Tweet

P.S. Whenever you’re ready, here are some other ways I can help fast track you to your Freedom goal (you’re closer than you think) :

1. Schedule a Call with Me:

If you’d like to replace your active practice income with passive investment income within 2-3 years, and you have at least $1M in available capital (can include residential/practice equity or practice sale), then click the link to jump on a quick call with my team. If it looks like there is a mutual fit, you’ll have the opportunity to schedule a call with me directly. www.freedomfounders.com/schedule

2. Get Your Free Retirement Scorecard:

Benchmark your retirement and wealth-building against hundreds of other practice professionals, and get personalized feedback on your biggest opportunities and leverage points. Go to www.FreedomFounders.com/Scorecard to take the 3 minute assessment and get your scorecard.

3. Ready to Step Away?

“How Much is Enough?” This simple question keeps hard-working professionals at the hamster wheel of active income far longer than they need to be. Watch this free training, and discover a proven model for determining how much you really need before hanging up the handpiece! www.freedomfounders.com/training

4. Apply To Visit The Mastermind:

If you’d like to join dozens of dentists, docs, and practice professionals on the fast track to Freedom (3-5 years or less), visit www.freedomfounders.com/step-1 to apply for a guest seat.